Chicago Cubs pitcher Luke Little was forced to change gloves during the team’s 4-3 victory over the Houston Astros ...

Cubs pitcher forced to change glove due to white in American flag patch: ‘Just representing my country’

John Wayne Gacy’s death row lawyer believes serial killer murdered dozens more

John Wayne Gacy killed more than 33 victims, and the "Killer Clown" didn't do it alone, his lawyer believes. Karen ...

JJ McCarthy hints to where he might be taken in 2024 NFL Draft: ‘I have somewhat of an idea’

Michigan’s J.J. McCarthy, a national title winner this past collegiate season, has been the quarterback who rose up everyone’s ...

Dog in Florida born with lime green fur named ‘Shamrock’ goes viral

While Kermit the Frog once said it's not easy being green, a Florida puppy born with green fur has ...

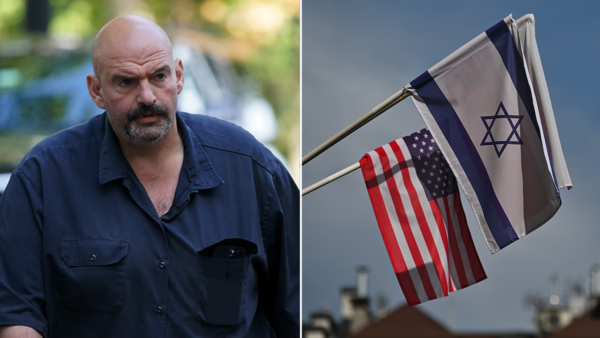

Fetterman’s ex-aides fume in private over Senator’s ‘love’ of attention, support for Israel: report

Former aides to Sen. John Fetterman, D-Pa., are voicing their disapproval with the Democratic senator over his staunch support for Israel, according […]

‘Political theater’: Leaked document exposes frustration inside key government security agency

EXCLUSIVE: A rebranding of Immigration and Customs Enforcement (ICE)’s investigative unit, purportedly due to “undue toxicity” that ICE faces from some on […]

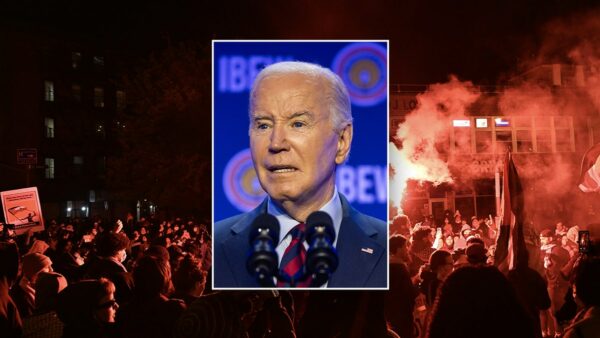

Anti-Israel protests may cost Biden election, supporters, journalists warn

As anti-Israel protesters continue to demonstrate across college campuses and rage at the White House’s stance on the war in Gaza, more […]

Patrick Mahomes gets invite to Royals spring training: ‘He’s welcome anytime’

Patrick Mahomes may be turning back the clock just a little bit.Before he became a three-time Super Bowl champion ...

‘Standing on a corner in Winslow, Arizona’ is one American community’s route to revival

Jackson Browne was a rising singer-songwriter in 1972 when he penned one of the most memorable lines in American ...

Philly sheriff slammed for allegedly losing guns, AI-generated news stories, thousands spent on mascot, DJs

Much like Dolton, Illinois self-declared "Super Mayor" Tiffany Henyard, Philadelphia Sheriff Rochelle Bilal has been slammed with allegations of ...

Measles confirmed in West Virginia in first case since 2009

A West Virginia hospital has confirmed the first known case of measles in the state since 2009, health officials ...

Chicago police release images of suspect wanted in shooting death of Officer Luis Huesca

Police in Chicago shared surveillance images of a suspect in connection to the murder of Officer Luis Huesca early Sunday morning as […]

AI could predict whether cancer treatments will work, experts say

A chemotherapy alternative called immunotherapy is showing promise in treating cancer — and a new artificial intelligence tool could help ensure that […]

Ex-NFL star against rookie QBs being thrown ‘into the fire’ as Caleb Williams likely to go No 1 to Bears

The Chicago Bears made the move to trade Justin Fields earlier in the offseason, which signaled they were likely going to take […]

Cubs pitcher forced to change glove due to white in American flag patch: ‘Just representing my country’

Chicago Cubs pitcher Luke Little was forced to change gloves during the team’s 4-3 victory over the Houston Astros on Wednesday night […]

John Wayne Gacy’s death row lawyer believes serial killer murdered dozens more

John Wayne Gacy killed more than 33 victims, and the “Killer Clown” didn’t do it alone, his lawyer believes. Karen Conti was […]

JJ McCarthy hints to where he might be taken in 2024 NFL Draft: ‘I have somewhat of an idea’

Michigan’s J.J. McCarthy, a national title winner this past collegiate season, has been the quarterback who rose up everyone’s draft board leading […]

Dog in Florida born with lime green fur named ‘Shamrock’ goes viral

While Kermit the Frog once said it’s not easy being green, a Florida puppy born with green fur has experienced internet stardom […]