Military scientists have identified the remains of an Illinois soldier who died during World War II at a Japanese ...

WWII soldier who died in Japanese POW camp identified 81 years later

Coby White’s career-high points won’t count due to bizarre Play-In rule

Coby White's tremendous performance on Wednesday night helped his Chicago Bulls beat the Atlanta Hawks to move on in ...

Chicago voter confronts Mayor Johnson over ‘disrespectful’ migrant funding, says city united against him

An outraged Chicago resident spoke out against Mayor Brandon Johnson for re-purposing tax dollars for illegal immigrants shortly before ...

Georgia man accused of transporting millions of dollars worth of stolen Masters merchandise, memorabilia

A Georgia man is facing federal charges after being accused of stealing millions of dollars of Masters merchandise and ...

News Quiz: April 19, 2024

What’s the Trump twist? Who flaunted a Biden hat? Try to ace our quiz! (Jabin Botsford/Pool; Marco Bello/AFP via Getty Images) The […]

Fire in truck carrying lithium ion batteries triggers 3-hour evacuation in Ohio

Authorities evacuated an area of Ohio’s capital, Columbus, for several hours on Thursday out of fear that a fire in truck’s trailer […]

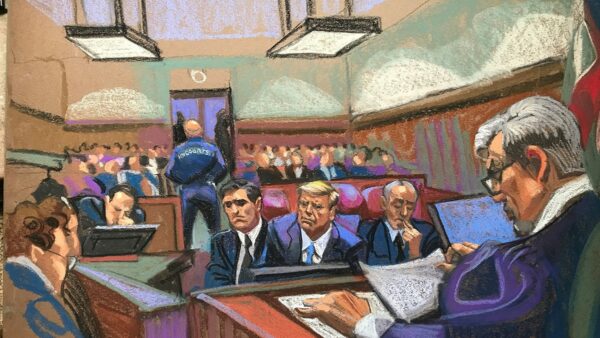

Fox News Politics: Trial and Error

Welcome to Fox News’ Politics newsletter with the latest political news from Washington D.C. and updates from the 2024 campaign trail. What’s happening? […]

MLB Buy or Sell: Braves fine sans Strider? Trout staying put? Phillies in trouble?

There's no shortage of storylines in Atlanta for a Braves team moving forward without strikeout artist extraordinaire Spencer Strider ...

2024 WNBA odds: Caitlin Clark heavy favorite for Rookie of the Year

Will Caitlin Clark have the impact in the WNBA that she had on college basketball? According to the odds, it's ...

Caitlin Clark fever impacts WNBA odds: ‘Her skills remind me of a young Steph Curry’

As the Caitlin Clark hype train rolls toward the WNBA, everybody wants a piece.Clark signed endorsement deals with the ...

Driver dead after fiery crash into Chicago-area toll plaza

A vehicle plowed into a suburban Chicago highway toll plaza early Thursday, engulfing it and the plaza in flames ...

Black Chicago voters rip mayor on extra $70M for migrants, as recall petition gathers steam

Infuriated Black Chicagoans showed up in force at a City Council meeting on Wednesday to protest Mayor Brandon Johnson’s request for an […]

Justice Department intensifies efforts to combat violent crime across US

The Justice Department is intensifying its efforts to reduce violent crime in the U.S. A specialized gun intelligence center has been launched […]

Huey Lewis not letting hearing loss define him, calls Broadway show his ‘salvation’

Huey Lewis has been a rock icon since the ’80s, and he’s doing his best to enjoy his status as an elder […]

WWII soldier who died in Japanese POW camp identified 81 years later

Military scientists have identified the remains of an Illinois soldier who died during World War II at a Japanese prisoner-of-war camp in […]

Coby White’s career-high points won’t count due to bizarre Play-In rule

Coby White’s tremendous performance on Wednesday night helped his Chicago Bulls beat the Atlanta Hawks to move on in search of the […]

Chicago voter confronts Mayor Johnson over ‘disrespectful’ migrant funding, says city united against him

An outraged Chicago resident spoke out against Mayor Brandon Johnson for re-purposing tax dollars for illegal immigrants shortly before the city is […]

Georgia man accused of transporting millions of dollars worth of stolen Masters merchandise, memorabilia

A Georgia man is facing federal charges after being accused of stealing millions of dollars of Masters merchandise and memorabilia from Augusta […]