A former Nebraska deputy is jailed after a grand jury indicted him on suspicion of manslaughter in connection with ...

Former Nebraska deputy indicted on manslaughter charge in October shooting

McNeese State EVP is named Louisiana school’s next president

A new president has been named for McNeese State University in southwest Louisiana.The University of Louisiana System announced Thursday ...

Former NBC News ‘disinformation’ reporter becomes CEO of The Onion

NBC News' former "disinformation" reporter has become CEO of the fake news website The Onion."NEWS: My friends and I ...

Bears’ NFL Draft picks Caleb Williams, Rome Odunze already best friends after hilarious interaction in Detroit

The Chicago Bears' two top 10 selections in the 2024 NFL Draft are already best friends. Caleb Williams, the new ...

2024 NFL Draft: Where did top 3 wide receivers land?

The top three receivers in the 2024 NFL Draft class have found their new homes in the pros. Let’s take a look […]

Chicago’s selective schools grapple with budgets woes due to new equity policy: report

Chicago Public Schools’ (CPS) new funding formula has reportedly impacted the district’s most selective and competitive schools. CPS officials in March voted […]

Bears select Caleb Williams with No. 1 pick of 2024 NFL Draft

The Chicago Bears did what was expected of them, taking USC quarterback Caleb Williams with the first overall pick of the 2024 […]

Caleb Williams talks fashion style ahead of draft: ‘I paint my nails, I wear unique things’

Caleb Williams, the likely No. 1 pick of the 2024 NFL Draft, talked to NFL Network on the red ...

Minneapolis ordinance imposes highest minimum cigarette price in America

Smokers in Minneapolis will pay some of the highest cigarette prices in the country after the City Council voted ...

Man was shot 13 times in Chicago traffic stop where officers fired nearly 100 rounds, autopsy shows

A man killed in a traffic stop last month when plainclothes Chicago police officers fired their guns nearly 100 ...

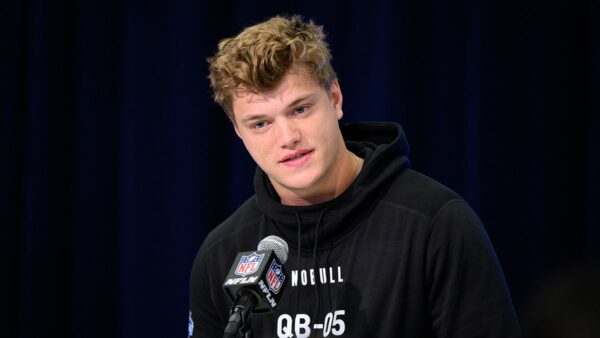

NFL Draft prospect Jayden Daniels shrugs off rumored issues with Commanders: ‘I’m blessed to go wherever’

Heisman Trophy winner Jayden Daniels is one of the top prospects entering this year's NFL Draft. The former LSU ...

J.J. McCarthy’s fiancée pens farewell to Michigan ahead of NFL Draft, ‘excited’ for next chapter

Michigan quarterback J.J. McCarthy’s entire world will change Thursday night, when he’s expected to be taken in the first round of the […]

Former NFL player Merril Hoge not impressed by Drake Maye: ‘He’s marginal at best’

Former Pittsburgh Steelers star Merril Hoge directed some sharply pointed criticism toward NFL Draft prospect Drake Maye. While Maye is widely projected […]

Michael Penix Jr’s perseverance through injuries a ‘positive,’ will improve any NFL roster, Rome Odunze says

Rome Odunze could be among the first players taken off the board in Thursday’s NFL Draft. His Washington Huskies teammate Michael Penix […]

Former Nebraska deputy indicted on manslaughter charge in October shooting

A former Nebraska deputy is jailed after a grand jury indicted him on suspicion of manslaughter in connection with the shooting death […]

McNeese State EVP is named Louisiana school’s next president

A new president has been named for McNeese State University in southwest Louisiana. The University of Louisiana System announced Thursday that Wade […]

Former NBC News ‘disinformation’ reporter becomes CEO of The Onion

NBC News’ former “disinformation” reporter has become CEO of the fake news website The Onion. “NEWS: My friends and I now own […]

Bears’ NFL Draft picks Caleb Williams, Rome Odunze already best friends after hilarious interaction in Detroit

The Chicago Bears’ two top 10 selections in the 2024 NFL Draft are already best friends. Caleb Williams, the new face of […]