Should companies be hiring or firing? Demand for workers has roared back over the past two years. But labour supply has not kept pace, and shortages are pervasive. That means many firms need to hire. On the other hand, fears of recession are widespread. Some bosses suspect they already have too many workers. Mark Zuckerberg has told Facebook employees that “there are probably a bunch of people who shouldn’t be here”. Tim Cook, the head of Apple, takes the middle course. Apple will continue to hire “in areas”, he said recently, but he was “clear-eyed” about the risks to the economy.

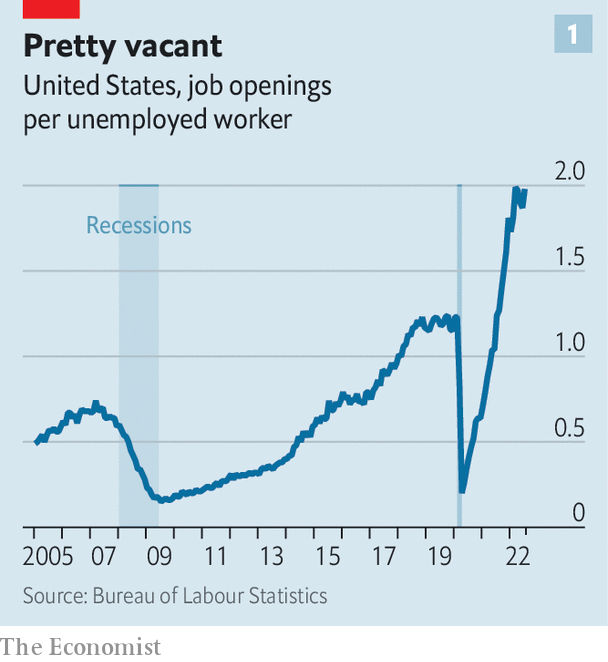

For now the hirers are trumping the firers. Figures released on September 2nd show that American employers, excluding farms, added 315,000 workers to payrolls in August. The Jobs Openings and Labour Turnover Survey (jolts), released a few days earlier, found 11.2m job openings in July. America’s unemployment rate ticked up from a 50-year low of 3.5% to 3.7%, but only because of a sudden influx of jobseekers to the labour market. Put another way, there were almost two job vacancies for every unemployed person in America (see chart 1). The situation in Britain is similar. The Bank of England forecasts a protracted recession. Even so, Britain has a near-record level of vacancies. Businesses in both countries are hiring as if a downturn might never come.

To understand these puzzling jobs trends, keep three important influences in mind. First, there is always a lot of churn in the labour market. The foundations of economic theory treat firms as if they are all the same, and the economy is just this “representative firm” writ large. In reality, companies differ from one another. Some expand, while others shrink—in booms and in busts. The firms that will be forced to fire workers in any recession are probably not the same as those that are furiously hiring now.

A second factor is what Steven Davis, of the University of Chicago’s Booth School of Business, calls the “great reshuffling”. This refers to a post-pandemic shakeup in employment in response to changes in the preferences of workers. It explains a lot of the frantic activity in the jobs market. The third issue is that organisations have limited bandwidth. In principle, a well-run business could recruit strategically across the business cycle. Some, like Apple, appear to do so. Ryanair hoarded staff during the pandemic hiatus and began hiring aggressively as the economy reopened. Its planes have kept flying this summer, while rivals have cancelled flights. But such firms are exceptions. Most businesses are not nearly as nimble.

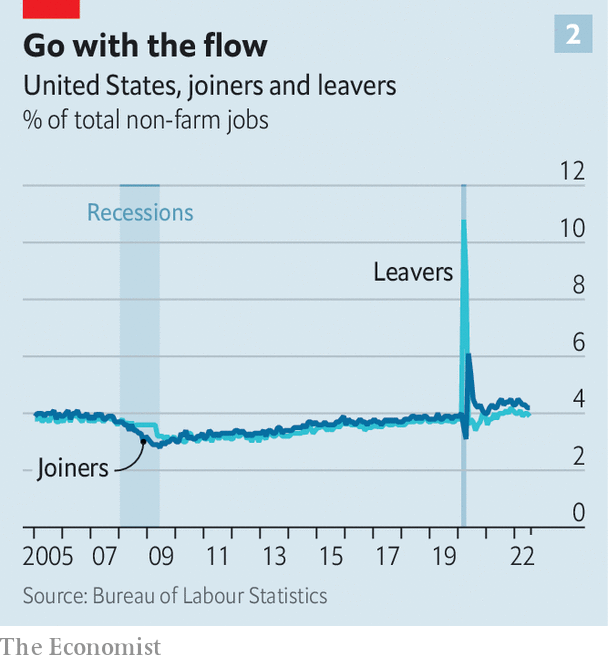

Start with the perennial churn in the jobs market. The change in employment captured by indicators such as the monthly non-farm payrolls is a net figure. It is the difference between two flow measures—between job creation and job destruction by enterprises, and between joiners and leavers at the level of workers. These flows are large in comparison with the change in employment. In July payrolls rose by 0.5m, but around 6.5m workers took new jobs and 5.9m left their old jobs.

The jolts data captures the rate of worker flows in a single month (see chart 2). Over the course of a year, an even larger number of people move from job to job, or from not working to working (and back). A rule of thumb is that jobs flow at a slower rate than workers flow. (Imagine a hypothetical firm with two joiners and one leaver: workers move but the net change is one created job). In expansions, the rate of job creation trumps destruction. In recessions, job destruction is greater. But churn is remarkably high at all times. Some hiring firms are also firing firms. Walmart, the largest private employer in America, recently confirmed that around 200 jobs would go at its headquarters. But the retailer said it was also creating some new roles.

While jobs are being created in the aggregate, not every business is furiously hiring. For some firms a cyclical downturn is forcing a rethink on staffing. Planned layoffs at companies like Shopify, Netflix or Robinhood are a correction to previous bouts of rapid hiring. For other businesses, layoffs are a response to deeper structural challenges. In February Ford’s boss, Jim Farley, was blunt about his firm’s challenges: “We have too many people; we have too much investment; we have too much complexity”. In manufacturing, the need to cut jobs invariably means people get fired. But there are industries, notably retailing, where the normal rate of turnover is so high that jobs can be cut without any layoffs. Just stop hiring, and payrolls will shrink.

This leads to the second big issue on recruitment: the great reshuffling. A recent study by Eliza Forsythe, of the University of Illinois, and three co-authors portrays a jobs market in which the demand side was not changed much by the pandemic. Many of the 20m American workers laid off in April 2020 were quickly recalled by their employers. But the supply side was more radically altered. The number of adults in work as a share of all adults—the employment-to-population ratio—remains below its pre-pandemic peak. Much of this is down to older workers retiring from the workforce, say the authors. Another consequence of the pandemic has been a struggle to fill customer-facing jobs. The surge in vacancies is especially marked in the leisure, hospitality and personal-care industries.

It is much the same in Britain. On a boiling hot weekday in August, dozens of businesses have set out their stall on the campus of the University of Middlesex in Barnet, a London borough. These firms are looking to fill a backlog of vacancies. The target applicants are not graduates, but the local unemployed. Among the companies are JH Kenyon, a funeral directors; Metroline, a bus company; and Equita, a debt-collection agency. Many recruiters say applicants used to come to them—a “constant pipeline”, says one stallholder. But now firms need to go out and drum them up.

Employers in America are also stepping up the intensity of recruitment. Skills requirements in ads for customer-facing jobs have been relaxed. Pay has picked up more sharply than in other kinds of work. Ms Forsythe and her colleagues find an increased likelihood of unemployed and low-skilled workers moving into white-collar jobs. Opportunities on the higher rungs of the jobs ladder appear to have opened up, because of retirements.

The third big influence on recruitment trends is organisational capacity. The huge crosscurrents in the economy are taxing the capabilities of business. Apple sells discretionary goods. It has to keep an eye on the cycle, because in downturns people will delay upgrading their Mac or iPhone. But for a lot of firms even the certainty of a recession in 12 months’ time would not be enough knowledge to help them fine-tune their recruitment strategy. They would need to know the magnitude, duration and industry characteristics of any recession, and not only the fact and timing of it. Turning hiring on and off in response to subtle cyclical shifts is not feasible for a lot of firms. Bosses need to ensure the whole organisation is aligned on objectives. Firms, like people, have limited bandwidth.

And recession fears are probably not the main influence on recruitment strategy just now. For many employers, says Mr Davis, the key decision is whether and how to accommodate the desire of employees to work from home. There is a spectrum of responses. At one extreme is Elon Musk, who has gruffly demanded that Tesla employees turn up in the office for at least 40 hours a week or “pretend to work somewhere else.” At the other end is Yelp, a popular review website, which favours a “remote-first” strategy, and Spotify, which has a “work from anywhere” policy. This approach has advantages in a tight jobs market. A firm can cast its recruitment net over a wider area. And there is evidence that remote workers will trade greater flexibility for lower pay. But there are obvious downsides, too. It is tough to sustain corporate culture or unity of purpose when colleagues barely meet.

For some kinds of firms, the cycle will eventually bite. A lot of the historical cyclicality in hiring is down to high-growth startups and newish businesses, says John Haltiwanger of the University of Maryland. In booms, providers of capital—whether venture-capital funds, banks or public-market investors—are willing to fund all kinds of enterprises. But in downturns investors become averse to risk. And young firms without a long track record find it harder to finance their growth. Hiring across the economy then suffers.

It is natural to believe that your firm is recession-proof, and that your rivals will suffer. The archetypal “man in a van”, who specialises in renovations, will struggle next year, says a recruiter at the Barnet jobs fair. Bigger building firms that are part of large infrastructure projects, such as his, have a pipeline of projects. But with workers so scarce, he is as clear-eyed as Mr Cook about what is possible. “You just need to be able to turn up on time and show some willingness and commitment,” he says of his target applicant. “No previous experience is required.” ■